HMRC Call Time on the Winding up Petition (for now)

by Greg Connell, Managing Director of InfolinkGazette

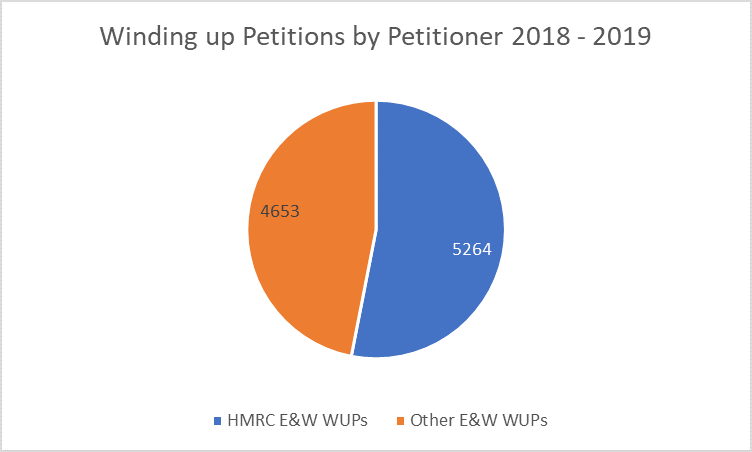

Petitioning the courts for the winding up of a creditor is the process for bringing about a compulsory

liquidation when all other approaches to retrieve a debt have failed. HMRC have long been the

greatest proponent of the winding up petition (WUP), accounting for 63% of all WUPs in England &

Wales and 74% in Scotland over the last 2 years.

It was starting to look like WUPs might become a dead end when The Lord Chief Justice’s Review of

Court Arrangements due to COVID-19, dated 23rd March 2020 ordered that the general winding up

list couldn’t be conducted remotely and that the Petitions should be adjourned. Over 100 WUPs

were adjourned that week, with the earliest adjournment dates in June 2020. Once a company’s

bank sees the petition, they usually freeze the bank account, at least until the petition is dismissed,

so this would have created thousands of zombie companies that would all have been the subject of a

winding up petition that had come to a dead halt. Fortunately, the Insolvency & Companies Court

adapted rapidly to the emergency situation and now intends to progress winding-up cases remotely,

rather than continuing to adjourn them. The Companies Court Winding Up Cause list is now being

updated again and there are no more indiscriminate adjournments, so it should be game back on for

hearing WUPs.

What has changed, is that HMRC will not be amongst the petitioners. Greg Connell, MD

InfolinkGazette said: “it looks like the COVID-19 forbearance order got to HMRC on the 7 th March

2020 because there hasn’t been a single HMRC petitions since then.”

In an April 2020 update from the Insolvency Service, Insolvency Practitioners were advised “HMRC has paused the majority of all insolvency activity for now. That means HMRC will not petition for bankruptcy and winding up orders unless it is deemed to be essential, i.e. fraud, criminal activity.”

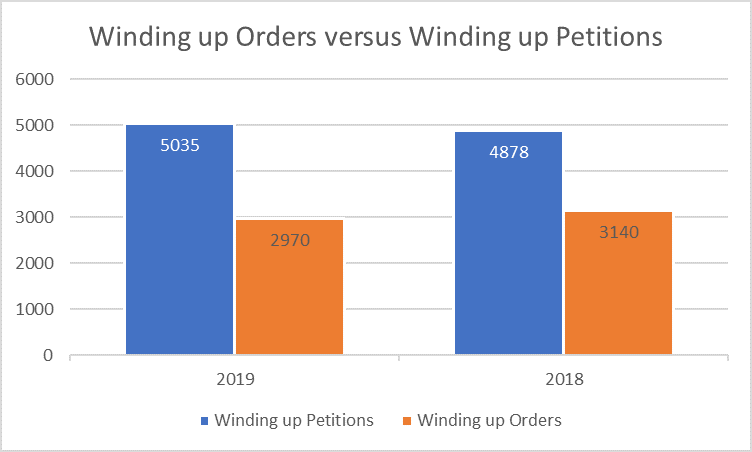

In 2019, there were 2,970 Compulsory liquidations from 5,035 WUP, so a wind-up rate of 59%, down from 64% in 2018, when there were 3,140 compulsory liquidations from 4878 WUPs.

In an April 2020 update from the Insolvency Service, Insolvency Practitioners were advised “HMRC has paused the majority of all insolvency activity for now. That means HMRC will not petition for bankruptcy and winding up orders unless it is deemed to be essential, i.e. fraud, criminal activity.”

In 2019, there were 2,970 Compulsory liquidations from 5,035 WUP, so a wind-up rate of 59%, down from 64% in 2018, when there were 3,140 compulsory liquidations from 4878 WUPs.

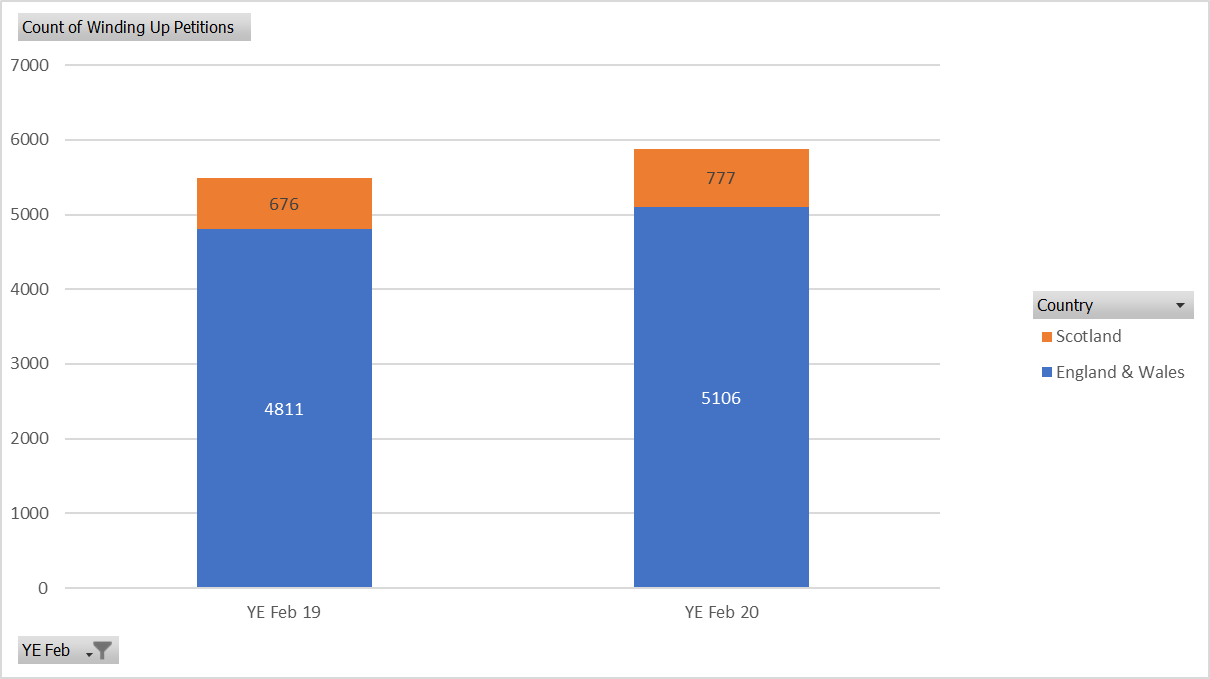

Up until the COVID-19 crisis, WUPs had been on an upward trajectory, increasing 6% in E&W to 5106

on the year to end of Feb 2020, and up 14.9% to 777 in Scotland.

Greg Connell, MD InfolinkGazette said: “we’ll continue to provide our customers with daily feeds of winding up petitions, but it is already clear that they will be at significantly reduced volumes, and the wind-up rate is set to drop.”

Assuming a 3-month period of HMRC forbearance the number of WUPs in 2020 will fall from an annualised 5106, to 4,320, down by 786. And, based on the rolling 2-year wind-up rate of 62%, there will only be 2678 compulsory winding up orders, 292 fewer than in 2019.

Greg Connell, MD InfolinkGazette said: “unless the directors elect for a CVL, which is unlikely, that will be another 292 companies remaining in business and potentially continuing to seek trade credit, who haven’t paid their tax bill and the sword of Damocles is hanging over them.” Greg added: “worst of all, trade suppliers will have no visibility on who they are.”

Copyright © 2020 Credit Insurance News. All rights reserved.

All news stories on Credit Insurance News' website are included with the prior permission of the copyright holder. Reproduction or redistribution in whole or in part, in any manner, without the express prior written consent of the copyright holder, is a violation of copyright law. If you, or your organisation wish to redistribute, republish or link-to all or any part of any Credit Insurance News Digest, you must first contact the copyright holder direct or email sally.brown@creditinsurancenews.co.uk for further information.

All news stories on Credit Insurance News' website are included with the prior permission of the copyright holder. Reproduction or redistribution in whole or in part, in any manner, without the express prior written consent of the copyright holder, is a violation of copyright law. If you, or your organisation wish to redistribute, republish or link-to all or any part of any Credit Insurance News Digest, you must first contact the copyright holder direct or email sally.brown@creditinsurancenews.co.uk for further information.

Terms and Conditions Privacy and Cookie Policy © 2018 Credit Insurance News