by Simon Marshall FCICM, CEO, Co-pilot

Many brokers consider the biggest threat to their business to be self-insurance.

Insured clients can be driven in that direction through dissatisfaction with a number of key factors:

- The Credit Limit Service — this can be limits available, but it can also be about speed of limit delivery. We have worked with clients where this is a frustration because the credit team can be seen within their own business as a “Blocker”

- Rejected non-compliant claims — non-compliance can be viewed as an existential threat to the industry.

- The day-to-day complexity of running the programme. This is often expressed by clients as “I have to fit the insurer, rather than the insurer fitting me.”

Brokers and clients face a key frustration that use of the underwriter online system inhibits change of underwriter at renewal. For clients with large programmes this has proved to be a key issue.

A client platform tackles these challenges head on and leads to a much better user experience and to significantly improved policy outcomes.

How do client platforms work?

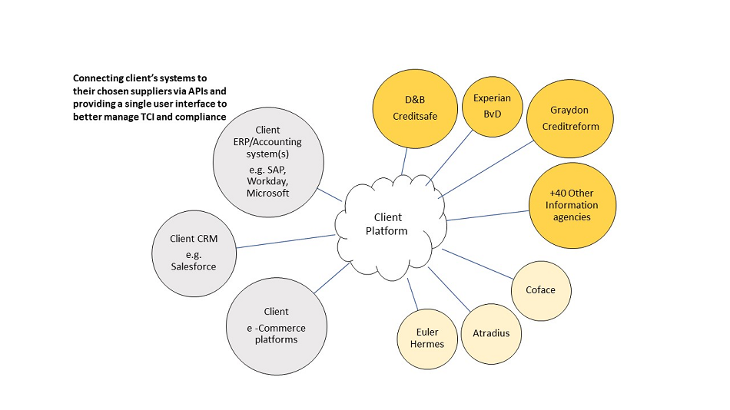

In managing credit risk, including Trade Credit Insurance (TCI), the client’s credit teams will typically have to operate in multiple internal

ERP/accounting systems, their CRM system, Credit Reference Agency (CRA) systems and the Underwriter online system(s). With a Credit Risk Management Platform, the client operates everything within a single platform which

then interfaces with all the other internal and external systems. This makes life very considerably easier for the client and brings some significant benefits to its business and to its use of TCI.

Key Client Benefits

Credit Limits

There are several ways in which a client platform can be configured to apply for new limits or limit increases before they are needed, reducing the perception of the TCI, as a “Blocker” It can also be configured to alert the broker when insufficient cover is provided so that the broker can initiate an appeal or top-up process. This is just one example of the pro-active client/broker collaborations that can be achieved — it’s all in the configuration.

Compliance

Manual processes, in and out of multiple systems almost invite non-compliance. A platform enables an automated, systematic approach to compliance, “front-to-back” from real-time DL limit calculation through reporting and audit trails. A compliant client, which can demonstrate that it has systematic processes, is more attractive to the underwriter, helping you to obtain improved terms.

Ease of use

A platform will automatically calculate and show the client what is available under the DL. It will do this in real time as payment experience or CRA data change. This obviates the need for the client to do annual reviews. It also obviates the need for manual Highest Cleared Balance calculations.

The client is alerted when anything needs to be reported to the underwriter. He or she can then review the alert and decide whether or not to send it in. Turnover Declarations are automatically produced. The system will do about 80% of the work, leaving the client to top and tail it as appropriate.

One of the big plusses is that the client no longer needs to go in and out of multiple systems. No Co-pilot client would ever go back to manual processes — it would make no sense.

Ability to change underwriter or to run multiple underwriter programmes

For many Co-pilot clients and their brokers this has proved to be the single most important issue.

Why Co-pilot

We are independent, performing the equivalent of the broker role but specialising in risk technology. Neither clients nor brokers can reasonably be expected to have the knowledge and experience to know how to structure a solution and to know which vendors to partner (see case studies).

Co-pilot is pioneering a concept which will bring the Trade Credit Insurance and Invoice Finance sectors closer together. We call it “Digital Collaboration”, and it will be to the benefit of all participants, creating opportunities for business development and even product development.

Conclusion

Perhaps the key thing is that a platform enables the TCI programme to fit the client, and for the client to derive enhanced satisfaction and use from its TCI programme. Brokers will benefit from being pro-active and having a client solution available. Co-pilot is here to help you make that a success story.

Credit Limits

There are several ways in which a client platform can be configured to apply for new limits or limit increases before they are needed, reducing the perception of the TCI, as a “Blocker” It can also be configured to alert the broker when insufficient cover is provided so that the broker can initiate an appeal or top-up process. This is just one example of the pro-active client/broker collaborations that can be achieved — it’s all in the configuration.

Compliance

Manual processes, in and out of multiple systems almost invite non-compliance. A platform enables an automated, systematic approach to compliance, “front-to-back” from real-time DL limit calculation through reporting and audit trails. A compliant client, which can demonstrate that it has systematic processes, is more attractive to the underwriter, helping you to obtain improved terms.

Ease of use

A platform will automatically calculate and show the client what is available under the DL. It will do this in real time as payment experience or CRA data change. This obviates the need for the client to do annual reviews. It also obviates the need for manual Highest Cleared Balance calculations.

The client is alerted when anything needs to be reported to the underwriter. He or she can then review the alert and decide whether or not to send it in. Turnover Declarations are automatically produced. The system will do about 80% of the work, leaving the client to top and tail it as appropriate.

One of the big plusses is that the client no longer needs to go in and out of multiple systems. No Co-pilot client would ever go back to manual processes — it would make no sense.

Ability to change underwriter or to run multiple underwriter programmes

For many Co-pilot clients and their brokers this has proved to be the single most important issue.

- A platform can cope with the run-off or management of the old policy at the same time as the adoption of the new arrangements — events are automatically pointed in the right direction as they happen.

- Different Buyer Grade systems (1-10, 10-1, 1-100) are blended into a single grade to create clarity and ease of operation

Why Co-pilot

We are independent, performing the equivalent of the broker role but specialising in risk technology. Neither clients nor brokers can reasonably be expected to have the knowledge and experience to know how to structure a solution and to know which vendors to partner (see case studies).

Co-pilot is pioneering a concept which will bring the Trade Credit Insurance and Invoice Finance sectors closer together. We call it “Digital Collaboration”, and it will be to the benefit of all participants, creating opportunities for business development and even product development.

Conclusion

Perhaps the key thing is that a platform enables the TCI programme to fit the client, and for the client to derive enhanced satisfaction and use from its TCI programme. Brokers will benefit from being pro-active and having a client solution available. Co-pilot is here to help you make that a success story.

Simon has worked for many years in the credit field internationally. He has held board positions in leading credit insurers and an invoice finance company and served as Chairman of the Trade Credit Insurance Committee, Association of British Insurers.

Simon currently serves on the Executive Committee of the Association of International Credit Directors and Professionals.